Once verification is complete, you’ll automatically return to your tax return to continue reviewing and signing.

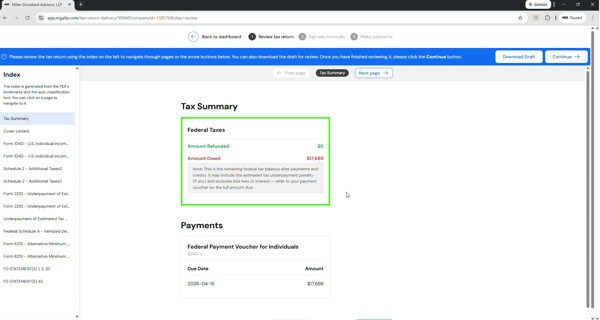

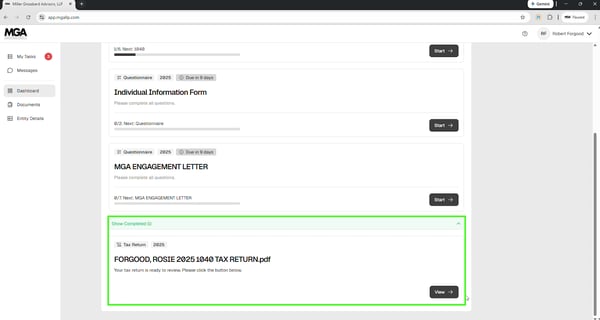

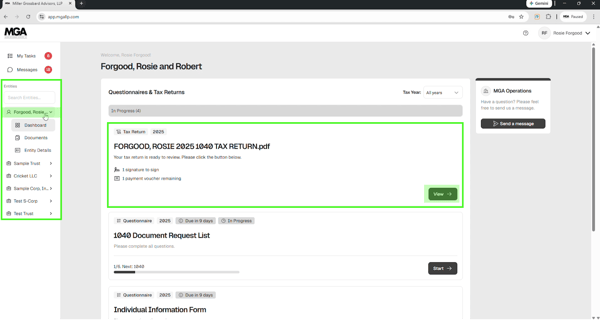

Reviewing Your Return

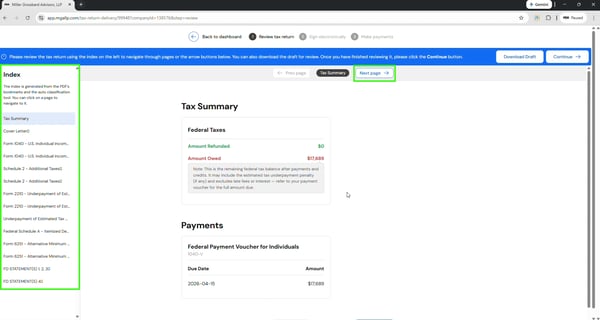

At the top of the screen, you’ll see a Tax Summary, which includes your refund amount or balance due.

To navigate through your return, you can:

- Use the "Next Page" button at the top, or

- Select specific forms from the menu on the left-hand side

Take your time reviewing each section. You can move forward or jump to different forms as needed.

Electronically Signing Your Return

Once you’ve finished reviewing the return, click "Continue" in the upper right corner to electronically sign your return. Here you will see any e-file authorization forms that need your signature. You may see a Form 8879 or various state forms. Any required signature areas will be clearly highlighted in green. Simply click in the highlighted area to sign.

If your spouse also needs to sign, they will receive their own email notification. Your return will not be marked complete until all required signatures have been submitted.

Making a Tax Payment (If Applicable)

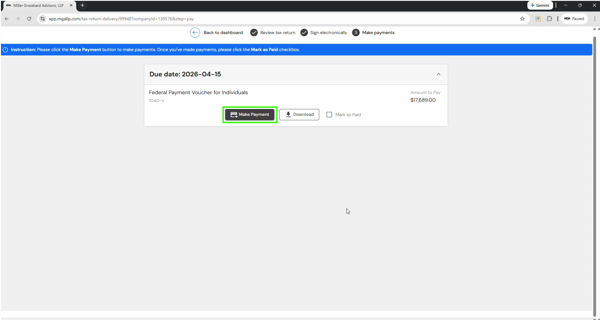

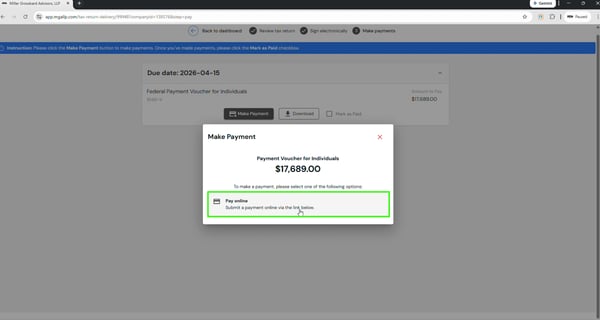

If a payment is required, you’ll see a "Make a Payment" option.

From there, click the payment link to be directed to the IRS website, where you can then choose to pay using IRS Direct Pay or the Electronic Federal Tax Payment System (EFTPS).

Need help completing your federal tax payment? Review our guides below:

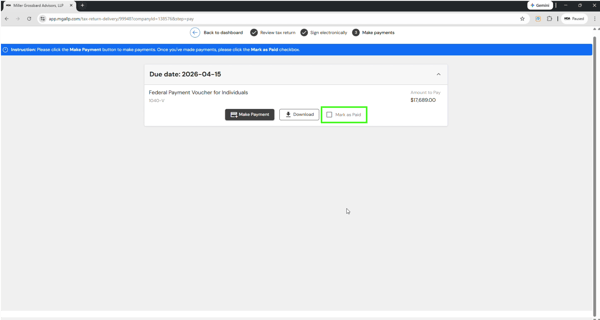

After submitting your payment, return to the portal and mark the voucher as paid to keep your dashboard accurate.

You’re Done — What Happens Next

Once all required signatures are submitted and any necessary payments are marked as paid, your return will move to the completed section of your dashboard. At that point, your return has been reviewed, signed by all parties, and paid if applicable.

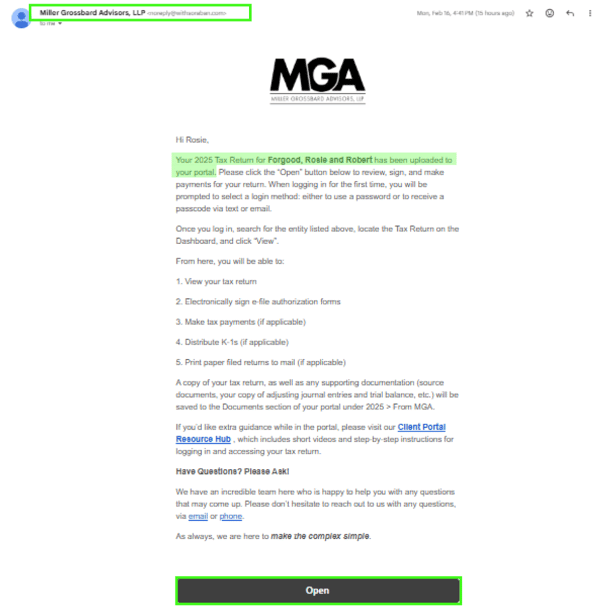

Have Questions? Please Ask!

We have an incredible team here who is happy to help you with any questions that may come up. Please don’t hesitate to reach out to us with any questions, via email or phone.

As always, we are here to make the complex simple.

.png?width=191&name=mgalogofinal-01%20(3).png)

.png)