At MGA, our commitment to making the complex simple is at the core of everything we do. From the technology we use to the way we support you, our goal is to make working with MGA as clear, secure, and straightforward as possible. One of the key tools that helps us do that is the MGA Client Portal.

In this guide, we’ll walk you through how to access and use the MGA Client Portal, with a particular focus on uploading requested tax documents. To make things even easier, we’ve also included a short video tutorial below that visually walks through each step, so you can complete the process quickly and confidently.

Accessing the MGA Client Portal

You will browse to app.mgallp.com to access your portal. We recommend bookmarking this link on your browser for easy access. Alternatively, we always have a link to the MGA Client Portal on our website, which you can see on the top right of this page.

ACCOUNT ACTIVATION

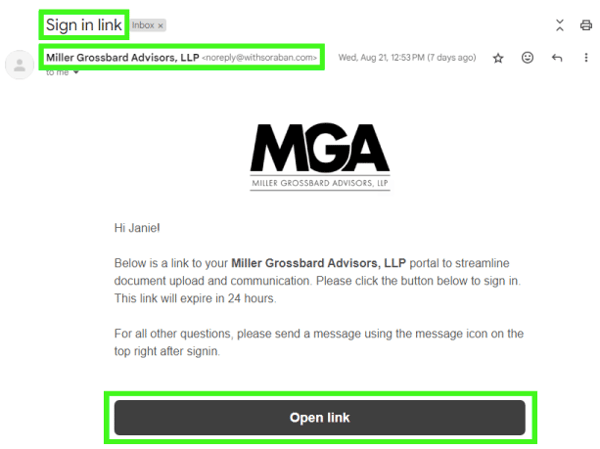

If this is your first time using the MGA Client Portal, you will need to activate your account. You will receive an email from Miller Grossbard Advisors, LLP (sent from noreply@withsoraban.com) with the subject line "Sign in link."

The email will ask you to click an attached link to access your portal.

Once you click this link, you will see a pop-up asking, "How do you want to sign in next time?" Here, you can choose to set up your portal with a password, text passcode, or email passcode.

Navigating the MGA Client Portal

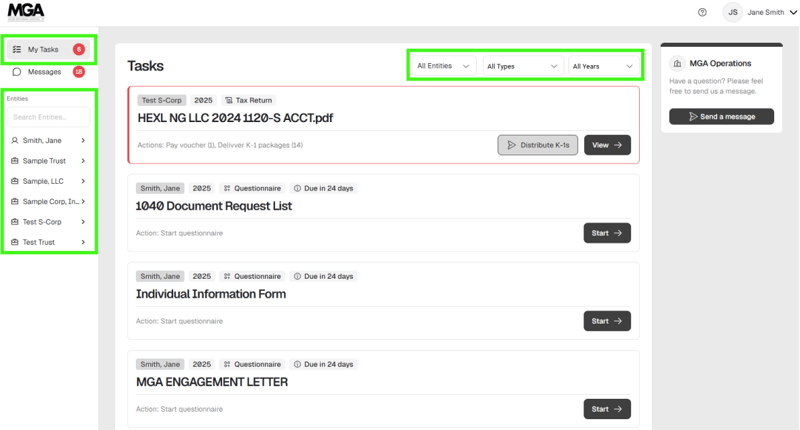

Once logged into your portal, your experience may look slightly different depending on how many entities you have access to. If you only have access to one entity, you’ll be taken directly into that portal. If you have access to multiple entities, you have two options:

-

View and manage all outstanding items across your entities by selecting "My Tasks" in the top-left corner. From there, you can use the All Entities, All Types, and All Years dropdowns at the top of the page to filter tasks by a specific entity, item type, or year. These areas are highlighted in the screenshot below.

-

Focus on a specific entity by selecting it from the "Entities" list on the left-hand side. You can either search for the entity by name or scroll through the list, then click the arrow next to the entity to view its associated items. These areas are also highlighted in the screenshot below.

⚠️It's important to note that if you have access to multiple entities, each entity will have its own dashboard and documents.⚠️

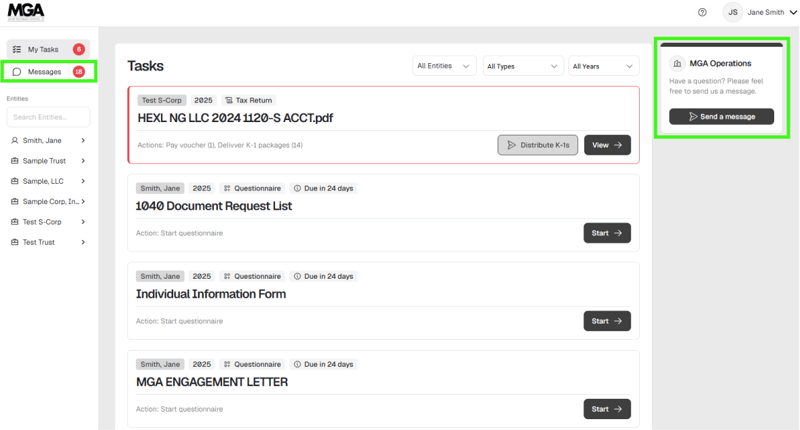

If you have a question, use the "Send a Message" button, which will take you to the "Messages" section to communicate with us further.

How to Upload Your Tax Documents in the MGA Client Portal

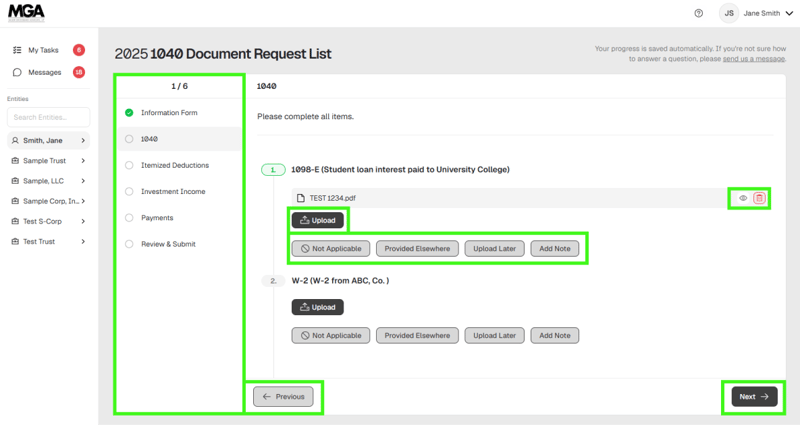

All the documents we need to prepare your tax return will appear on your Document Request List, which you can access at any time from your entity’s dashboard or through the "My Tasks" option, as outlined above.

When a Document Request List is first created for you, you’ll receive an email notification from Miller Grossbard Advisors, LLP (sent from noreply@withsoraban.com). The subject line will be similar to "Please complete 2026 1065 Document Request List for Sample LLC Account." This email includes an "Open Questionnaire" link, which will take you directly to the appropriate Document Request List in your portal.

Once inside a Document Request List — whether you accessed it through the email link, your entity’s dashboard, or "My Tasks" — you’ll see a page similar to the screenshot below. From here, you can review each requested item, upload documents, mark items as not applicable, and add notes as needed. You can also preview uploaded documents using the eye icon or remove them using the trash icon, both highlighted below.

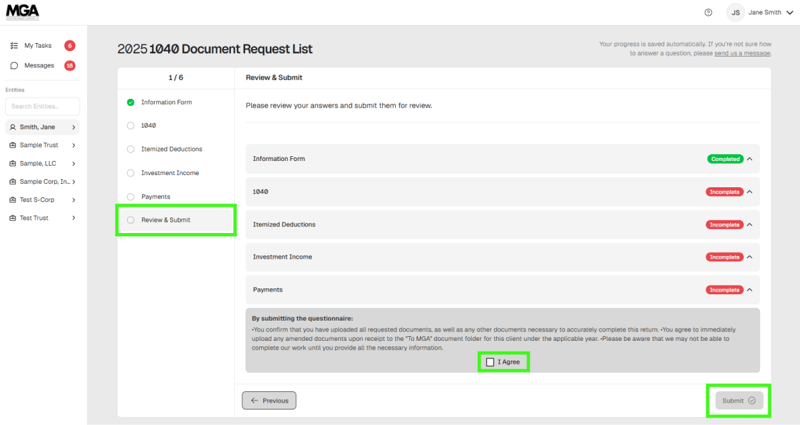

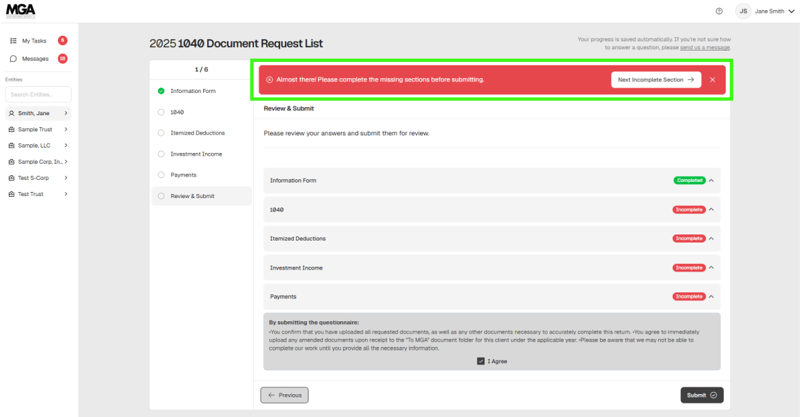

After navigating through each item on the questionnaire, you will come to the "Review & Submit" section. Check the "I Agree" box; then you can submit your answers.

⚠️If any sections remain incomplete, the system won’t allow you to submit the questionnaire, and you’ll see an alert similar to the screenshot below. That’s completely okay — any documents you upload are received by our team in real time. Even if you don’t have everything ready at once, uploading documents as they become available helps us begin our review and keeps the process moving smoothly.⚠️

Where to Find Your Completed Tax Return(s) in the MGA Client Portal

When your completed tax return has been uploaded to your portal, you will receive an email notification from our Operations Team with a subject line similar to "Tax Return(s): Sample LLC Account." The email will provide a link to your portal, where you can access and download your completed tax return.

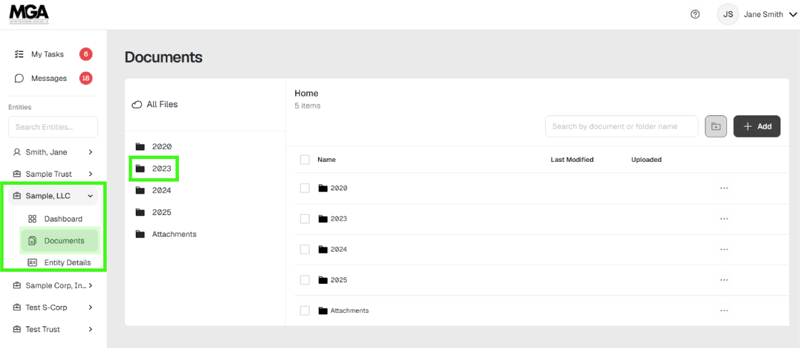

Once logged into your portal, navigate to the appropriate entity. If you have multiple entities, look under "Entities" list on the left-hand side and choose the same entity listed in the subject of the email you received.

From there, click into the Documents section. You will see a screen similar to the screenshot below.

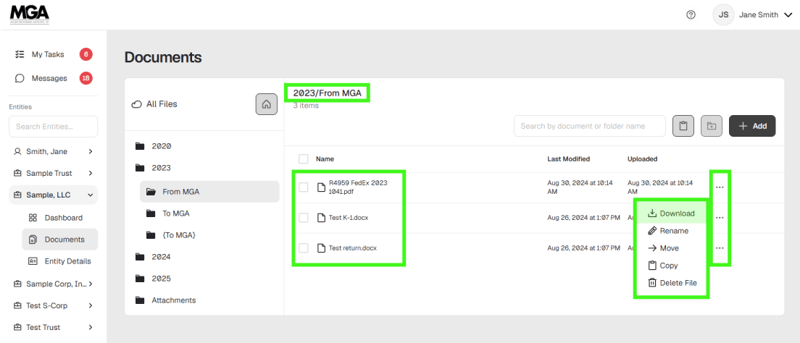

After clicking into the appropriate year's folder, click on the "From MGA" folder. Here, you will see a copy of your tax return and Form 8879, which needs to be signed and returned to us. To download these documents, click on the three dots beside the appropriate document and choose the download option.

Have Questions? Please Ask!

We have an incredible team here who is happy to help you with any questions that may come up. Please don’t hesitate to reach out to us with any questions, via email or phone.

As always, we are here to make the complex simple.

.png?width=191&name=mgalogofinal-01%20(3).png)

.png)