Write-off, you say? This is something that we talk about a lot with our clients. We get to the end of the year and clients are fearful of how much tax they will pay. They start asking about deductions and things they can write off. Just like Kramer says — all the big companies just write it off.

But what does "just writing it off" mean? It means that you just spent $1 on something to save yourself 37 cents in tax. That doesn’t seem like the best financial decision. Like we always say — don’t let the tax tail wag the dog. A good write-off is something that helps the company be more productive and make more profit.

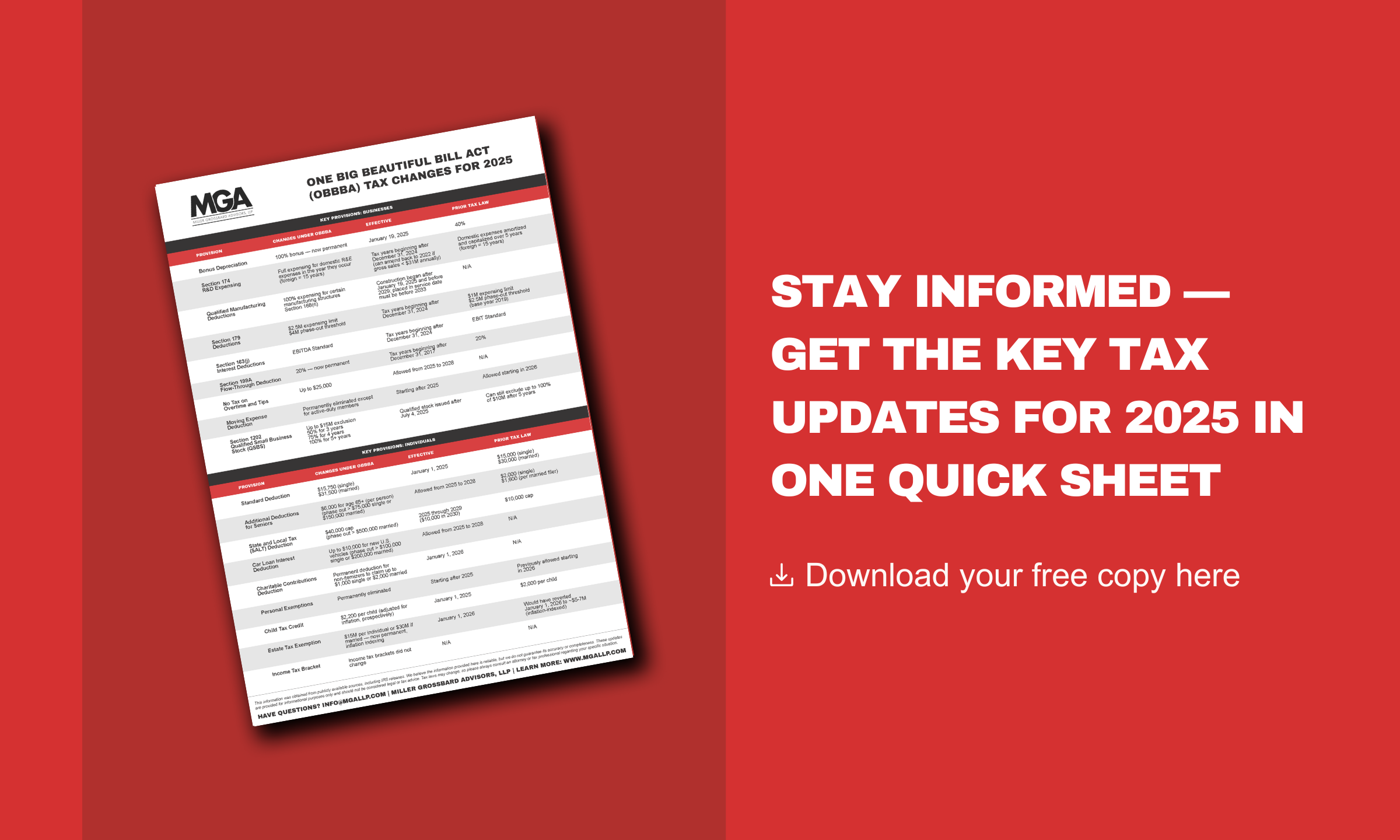

At MGA, we try to help clients find business write-offs that don’t necessarily cost extra dollars out of pocket. Some of these write-offs include accelerated depreciation, tax credits, and retirement options for the owners.

Accelerated Depreciation

MGA has expertise in assisting clients that own real estate. We work with our clients to understand what type of work they have performed on their properties. The IRS has specific rules for what needs to be capitalized and what is classified as a repair. We ask the right questions to truly understand the work that was done to see if it can be expensed versus capitalized. A significant area that our clients spend money on is improvements to the building itself and tenant spaces. We work with those clients to get the details of the work done so we can try to accelerate their deductions with shorter-lived assets. Most CPAs classify improvements as 39-year or 27.5-year assets without asking and digging in. We want to know the specific improvements done so we can try to find those assets that should be depreciated over 5 or 7 or 15 years. The value in those write-offs versus depreciating over 39 years can be dramatic.

When improvements are made to the building, the IRS also allows what is called Partial Asset Disposition. Let’s say you install a new roof ten years after you purchase a building. You spend $65,000 on a new roof. This is a new 39-year asset that must be depreciated. However, your original purchase of the property had the cost of a roof embedded in the price. We are allowed to “abandon” and write off the remaining undepreciated value of that old roof. This is another write-off that costs no additional money.

Tax Credits

Another overlooked business write-off is various tax credits that are available out there for things that companies are doing anyway. We work with clients to identify what these credits might be. A number of our clients have seen significant benefit from the research and development credit. They assumed you needed to be a scientific lab curing cancer to get this credit. We informed them that R&D credits are available and may reward their day to day efforts aimed at producing an improved product. We also talk with various clients about different employment credits that are available. Some of these credits have to do with hiring targeted groups of employees while others have to do with where the business is located. Additional write-offs for things you are doing that you didn’t even know existed!

Retirement Options

We also work with owners of the companies to identify ways they can save more for retirement versus paying Uncle Sam. Sometimes companies just have basic 401k plans, but they have never really examined the opportunity to use a profit sharing plan or a defined benefit plan. These are retirement plans that might allow the owners to get more substantial deductions by putting money into their own account. Now we are talking about write-offs for paying for your retirement! Let MGA work with you to evaluate if this makes sense for your company.

As Kramer said — all the big companies write off everything. Let your team at MGA help you identify write-offs you might not be taking advantage of.

We are here to assist you in navigating the complex IRS code. We are here to make it simple.

.png?width=191&name=mgalogofinal-01%20(3).png)