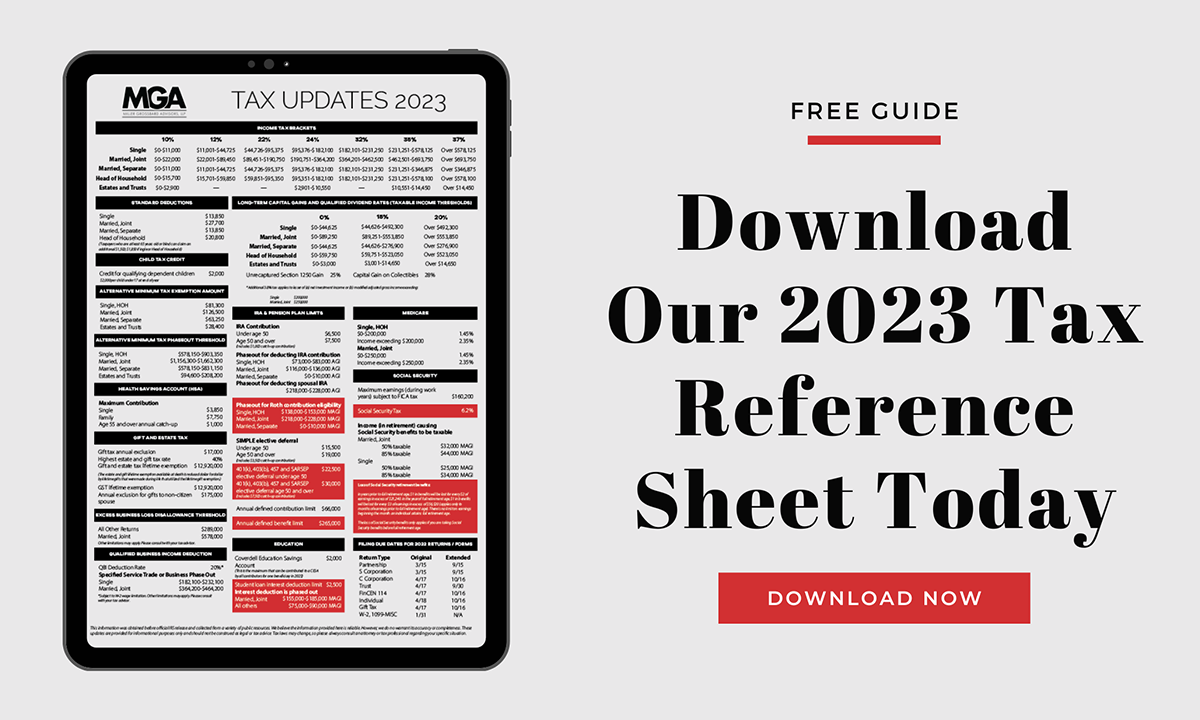

Our 2023 Tax Reference Sheet is now available and includes many of the most important 2023 federal tax rates, deductions, and limits. With tax planning being more critical than ever, we hope this guide helps you along the way.

What's Inside

|

|

If you have any have any questions about the information provided in this guide, please don't hesitate to reach out to us.

We are here to make the complex simple.

Subscribe Now!

Enjoy reading our articles? Click here to receive instant notifications as we publish new blog posts, videos, webinars, white papers, and more. Or, if you'd prefer monthly updates, you can subscribe here.

.png?width=191&name=mgalogofinal-01%20(3).png)