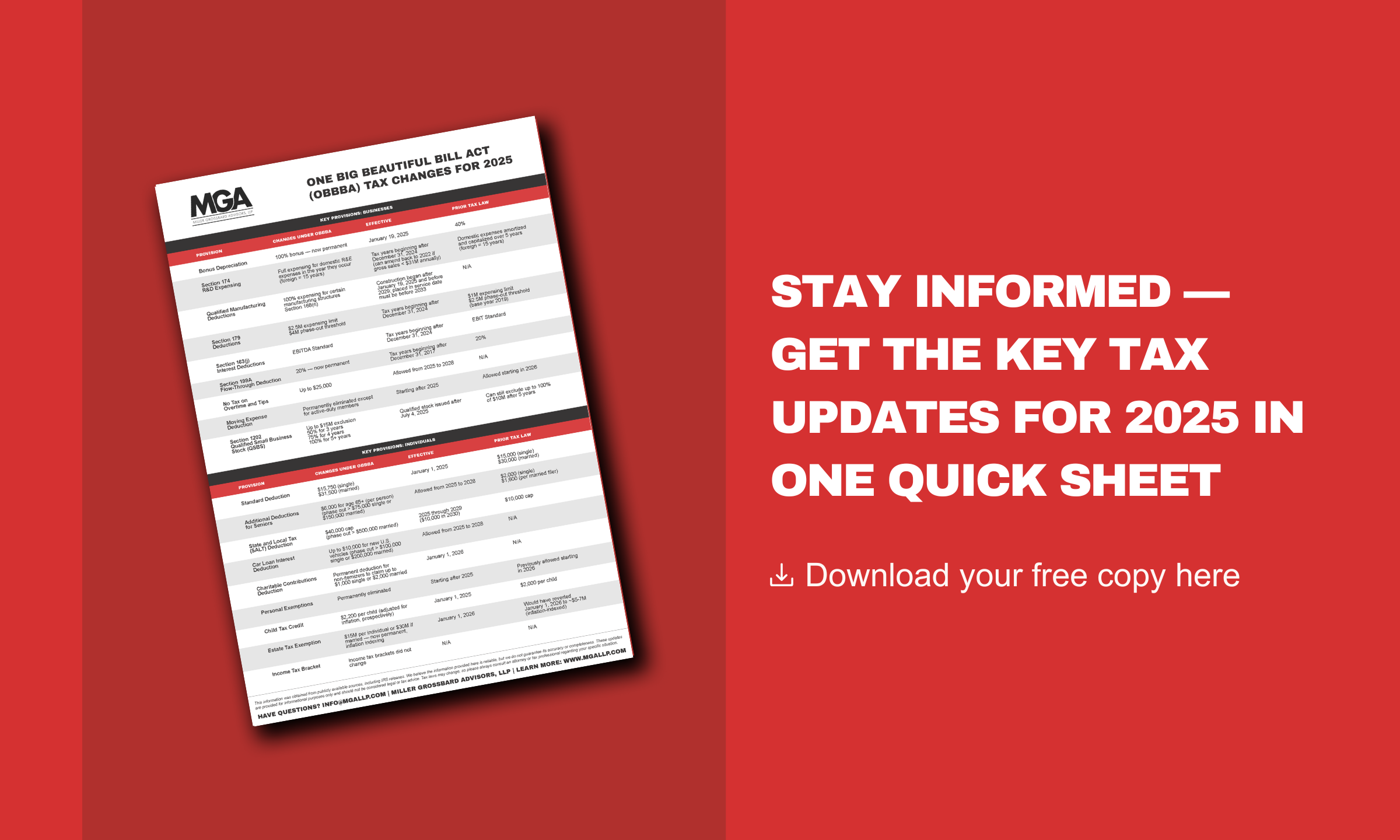

Our 2025 Tax Reference Guide is now available. It includes the most important 2025 federal tax rates, deductions, and limits to help you navigate the year ahead with confidence.

What's Inside? Key Tax Updates for 2025, Including:

- Income Tax Brackets

- Standard Deductions

- Child Tax Credit

- Alternative Minimum Tax Exemption Amount

- Alternative Minimum Tax Phaseout Threshold

- Health Savings Account (HSA)

- Gift and Estate Tax

- Excess Business Loss Dissallowance Threshold

|

- Qualified Business Income Deduction

- Long-term Capital Gains and Qualified Dividend Rates (Taxable Income Thresholds)

- IRA & Pension Plan Limits

- Education

- Medicare

- Social Security

- Filing Due Dates for 2024

|

Have questions? We're here to help — contact us here. We are here to make the complex simple.

.png?width=191&name=mgalogofinal-01%20(3).png)