Are you ready to go to prison?

That’s the question Lisa Bennet found herself wondering as she held the phone to her ear. Moments earlier, her home phone rang, and it was a call from a man claiming to be Officer Jason Dean with the IRS.

Lisa didn’t know it at the time, but the man was a criminal using one of the many IRS scam numbers. In an authoritative tone, he began explaining how an arrest warrant was out in Lisa’s name.

“There’s a warrant out for your arrest Mrs. Bennet, for failing to pay $5,347 in back taxes.” The fake officer even went on to explain how they would be there to put her under arrest within the next two hours.

Can you imagine being in Lisa's shoes? One minute you’re cooking a nice meal, and the next, your entire world is upside down. Putting her sons in the car, she rushed to the bank to get the requested funds.

Luckily, her bank was able to identify the scam before she withdrew any money. Not everyone is so fortunate.

5 Ways to Reveal If Someone Claiming to Be from the IRS Is a Scam

- Demanding Behavior

Scammers are aware of how nervous people get when they get a call or letter from the IRS. They will play off of this fear along with having personal information about you. For example, they might know your name, address, and other small pieces of information to make the call seem legitimate.

The first clue you’ll have is the demeanor of the individual on the line. Is the person calling you being demanding, threatening, or aggressive? Are they implying that this is a time-sensitive issue you should address right away?

If the supposed IRS agent seems rushed and urgently wants your payment, something isn’t right.

- Only One Way to Pay

The real IRS offers taxpayers a variety of ways to pay their taxes. Check, cash, direct debits, and more are all reasonable payment methods to expect.

However, scammers need access to your money immediately. They will have one specific way they want you to pay to help minimize their chances of exposure. This is a major red flag to be aware of.

- No Room for Rebuttals

Is the person on the other end of the line allowing you to object their claims? If the call is from a legitimate agent, they’ll direct you to the steps for an appeal. Taxpayers always have a chance to dispute any claims they feel are false.

- Requesting Sensitive Information

While the scammers may have some of your personal information, they’re still hungry for more. They will likely ask you for sensitive pieces of information, such as your social security number or banking information. The real IRS would never request your sensitive data over the phone.

- Making Threats

Finally, the last red flag to note is if you’re receiving a threat from the person on the other end of the line. Threats to put a lien on your property, put you in jail, revoke your license, and so on are all clear signs of a scam.

What to Do If You Get a Scam Call

Hopefully, you’ll never have to deal with IRS scammers, but if you do, there are steps you can take.

Start by asking for the individual's name and employee ID. They will likely not be able to give you any real information. Next, we suggest that you call the IRS and verify that your current taxes are up to date.

Remember: Legitimate Communications from the IRS Will Be Sent via Traditional Mail

At MGA, we want to stress that the IRS will not use the telephone, email, social media, or text message to contact you. They will not call you and threaten to lock you up if you don’t make an immediate payment. Tax scammers will frequently send out notices via these platforms, pretending to represent the IRS. Don’t fall for it.

On the other hand, we urge you and all our clients to not ignore any mailings from the IRS assuming that it could be a scam. If you’re unsure, contact your team at MGA immediately.

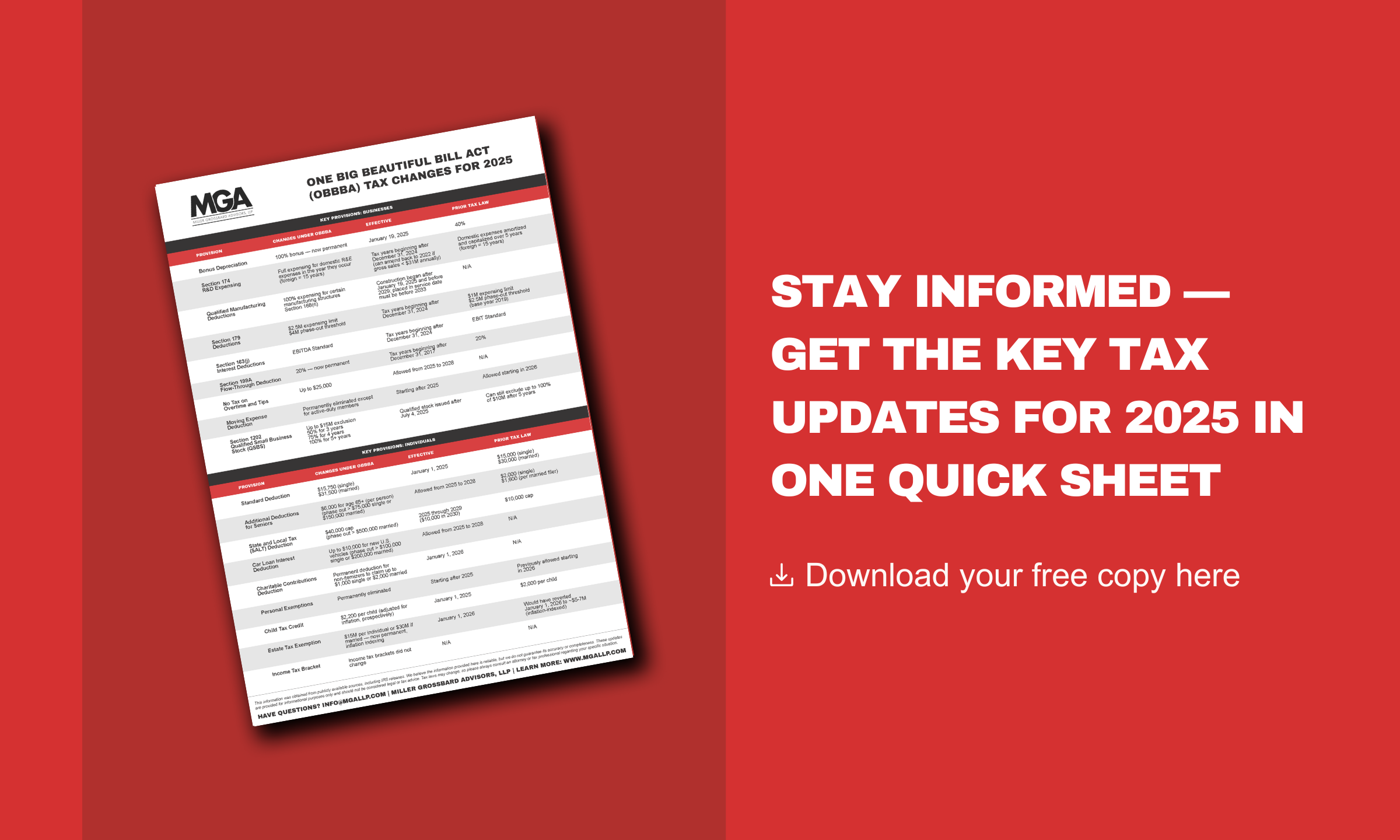

Here at MGA, we provide a wide variety of tax services that are designed to take the complexity out of all aspects of accounting, including the IRS, tax planning and more. We are here as your trusted advisors, no matter how simple or complicated your situation.

While you take care of your business, let MGA take care of you and the IRS.

.png?width=191&name=mgalogofinal-01%20(3).png)